In open banking, consumer-permissioned financial data flow from their financial institutions to TSPs through application programming interfaces (APIs)-a set of defined rules that enable different software to communicate and exchange data.

As a result, the data often became obsolete by the time TSPs provided consumers services.Ĭompared with screen scraping, open banking is more secure, more efficient, and instantaneous. Accessing a consumer’s account requires time and resources, and consequently, TSPs extracted consumer data less often. In addition, screen scraping is less efficient and may yield less timely data. A consumer’s bank account credentials are also more likely to be exposed to bad actors, as each TSP that provides financial services to a consumer stores their account credentials. The consumer’s bank cannot tell if the party logging in to the account is the accountholder, the consumer’s authorized third party, or a fraudster, and consumers and their banks do not have control over the amount and type of information extracted from accounts (such as account number, routing number, account balance, and transaction history). However, screen scraping is not a secure practice. Prior to open banking, TSPs primarily accessed consumer financial data through “screen scraping.” In this process, a consumer authorizes a TSP to log in to their bank account and extract data, often using a data aggregator to collect and package the data. Open banking: A new, better way to share consumer financial data with TSPs This Payments System Research Briefing describes the role of data aggregators in open banking and examines implications for the financial services industry. In open banking, data aggregators such as Finicity, MX Technologies, and Plaid play a critical but not well understood role. Such apps are made possible by open banking, a practice of electronically and securely sharing financial data-with the consumer’s approval-from the consumer’s financial institution with a third-party service provider (TSP).

:max_bytes(150000):strip_icc()/Venmo-568eab415f9b58eba47f01c2.png)

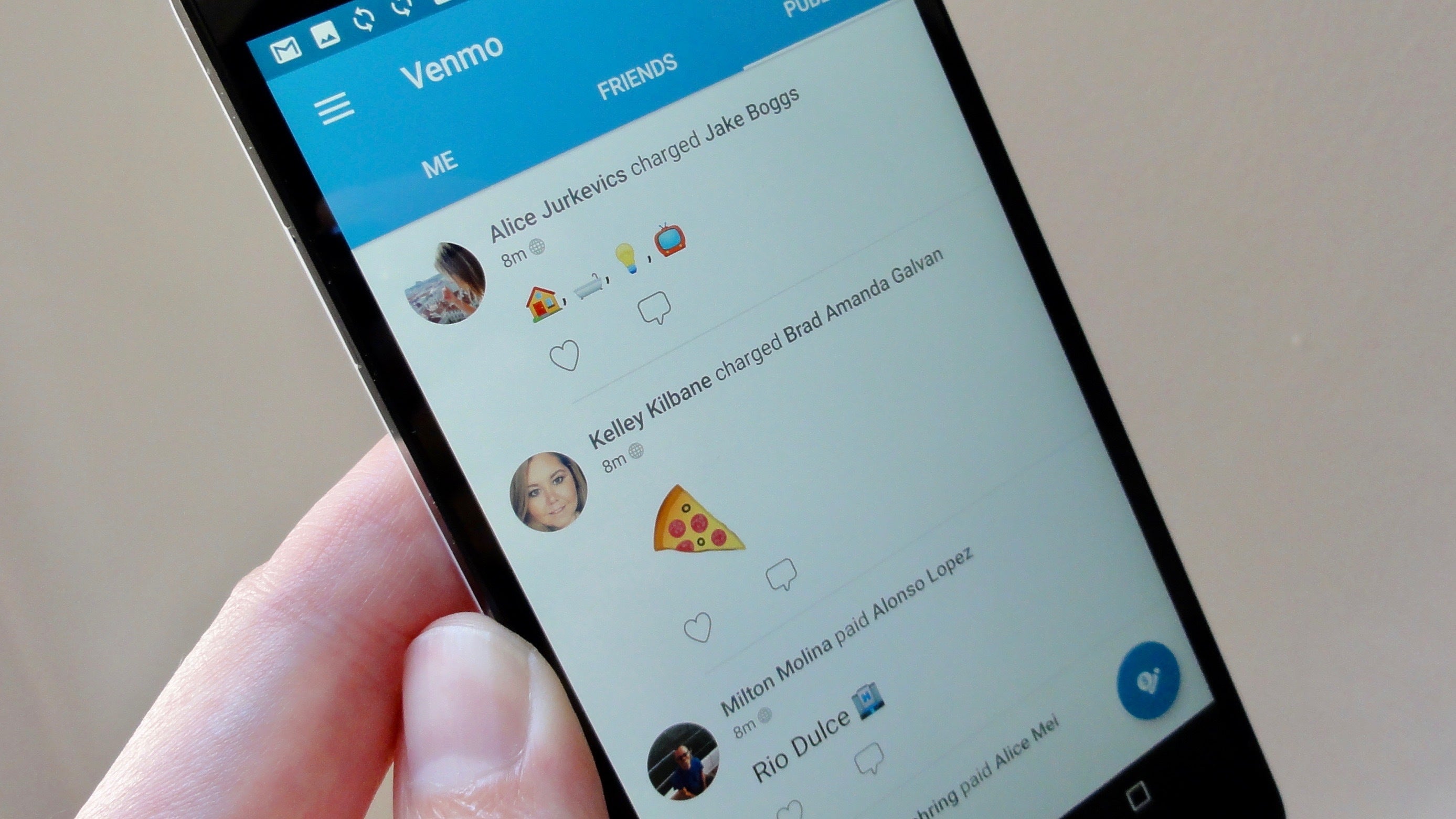

consumers are increasingly using financial apps offered by fintechs or nonbank service providers to manage budgets, make payments, and apply for loans.

0 kommentar(er)

0 kommentar(er)